Personal finance refers to the management of your money and financial resources. It is important to take care of your personal finances to ensure that you are able to achieve your financial goals and have financial security.

How budget 2023 plays role in our personal finance

The Union Budget 2023 is an important policy document that outlines the government’s expenditure and revenue plans for the upcoming financial year. It can have a significant impact on our personal finances in several ways. Here are some ways that the Budget 2023 can affect our personal finances:

Taxation:

The Budget 2023 may introduce changes to the tax code, such as changes to tax rates, deductions, and exemptions. These changes can have a direct impact on our personal finances, affecting how much we pay in taxes and how much money we have available to spend or save.

Infrastructure spending:

The Budget 2023 may allocate funds for infrastructure projects, such as roads, bridges, and public transport. These investments can create jobs, stimulate economic growth, and improve the overall standard of living. They can also affect property values and access to transportation, which can have a direct impact on our personal finances.

Social welfare programs:

The Budget 2023 may allocate funds for social welfare programs, such as education, healthcare, and housing. These programs can benefit individuals and families who need assistance, improving their quality of life and reducing financial stress.

Investment opportunities:

The Budget 2023 may introduce policies and incentives to promote investment in certain sectors of the economy, such as renewable energy, startups, or infrastructure. These policies can create investment opportunities that can benefit individual investors and help them to grow their wealth.

Inflation:

The Budget 2023 can impact the rate of inflation by affecting the money supply, interest rates, and overall economic growth. Inflation can erode the value of our savings and increase the cost of living, affecting our personal finances.

Overall, the Budget 2023 can have a significant impact on our personal finances, depending on the policies and measures introduced. It is important to stay informed about the Budget and its implications for our finances, and to make adjustments to our financial plans accordingly. This may include adjusting our spending, savings, and investment strategies to reflect the changing economic landscape.

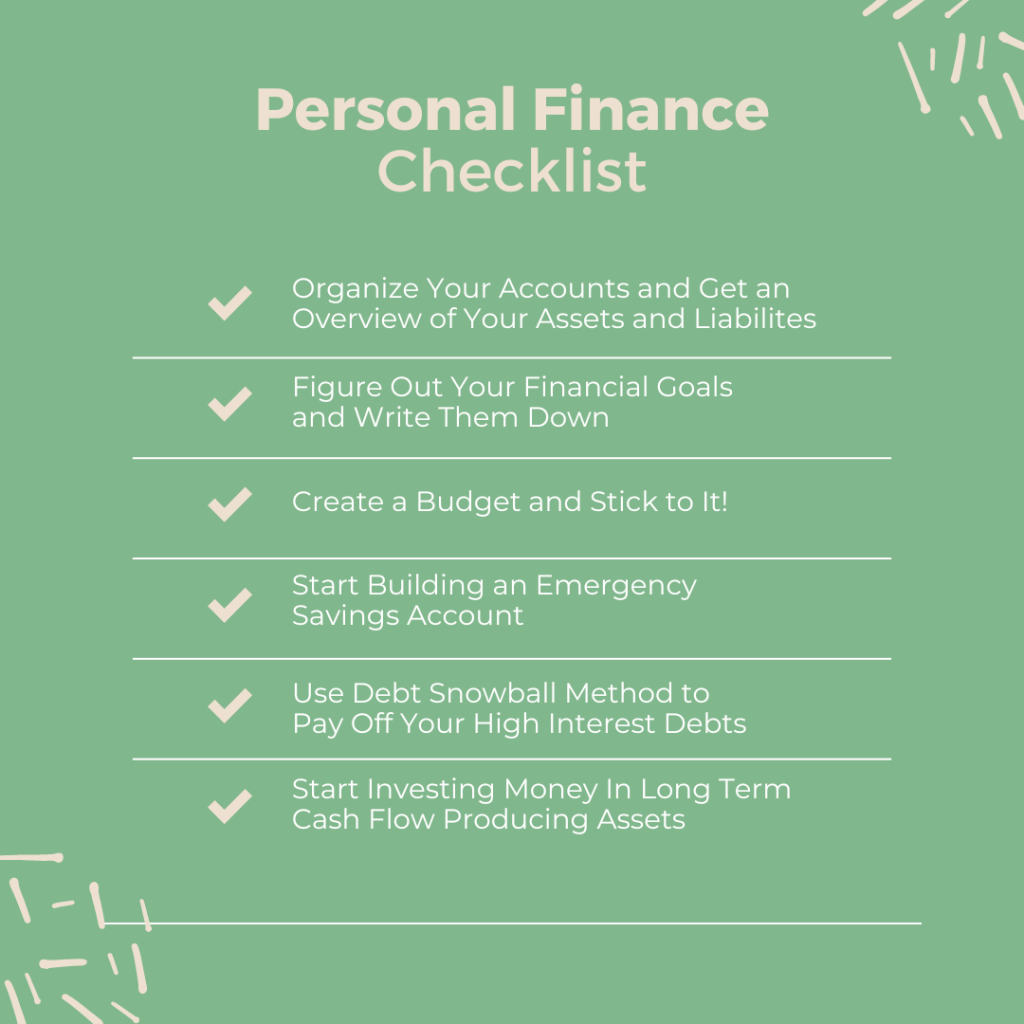

Here are some tips on how to take care of your personal finance

Create a budget

The first step in taking care of your personal finance is to create a budget. This involves listing your income and expenses and determining how much money you have left over after paying your bills. This will help you to understand your spending habits and identify areas where you can cut back.

Set financial goals

It is important to set financial goals so that you have something to work towards. Your goals could include saving for a down payment on a house, paying off debt, or saving for retirement. Once you have set your goals, you can create a plan to achieve them.

Build an emergency fund

An emergency fund is a sum of money that you set aside to cover unexpected expenses, such as a medical emergency or a car repair. It is important to build an emergency fund so that you do not have to rely on credit cards or loans to cover these expenses.

Manage your debt

If you have debt, it is important to manage it carefully. This means paying off high-interest debt first, such as credit card debt, and avoiding taking on new debt whenever possible. You can also consider consolidating your debt or negotiating with your creditors to lower your interest rates.

Save for retirement

It is never too early to start saving for retirement. Consider setting up a retirement account, such as an IRA or 401(k), and contributing regularly. This will help you to build a nest egg for your retirement years.

Invest wisely

If you have extra money, consider investing it to grow your wealth over time. This could include investing in stocks, bonds, mutual funds, or real estate. However, it is important to research your options carefully and to understand the risks involved.

Conclusion

Taking care of your personal finance requires discipline, planning, and a long-term perspective. By following these tips, you can ensure that you are making smart financial decisions that will benefit you in the long run. Remember, the key to financial security is to live within your means, save for the future, and invest wisely.

Comments 0